The first three months with MarketCycle Wealth Management are absolutely free… no management fee at all! This allows us time to prove our worth; after that our management fee is quite reasonable.

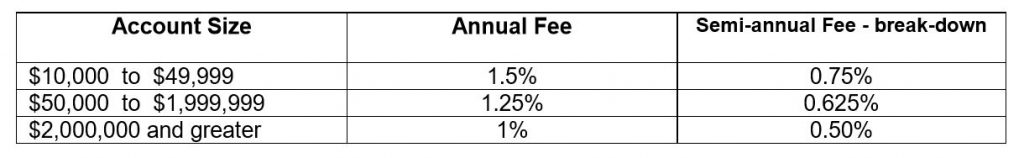

In 1995, the Securities and Exchange Commission (SEC) released the Tully Commission Report, which stated that investors would benefit from asset-based fees because investment professionals would be less likely to recommend sales just to boost commissions. MarketCycle Wealth Management agrees with this finding and therefore charges the following reasonable yearly fees for the total of individual client assets under management (we bill semi-annually):

There are no hidden fees that go to MarketCycle, no front-end fees, no redemption fees, no product commissions and, unlike hedge funds, we do not take a percentage of profits. We offer much of what a good hedge fund would offer, but at a much smaller cost to you. Retirement accounts are as easy to set up and fund as are regular accounts.

AN INTERESTING FACT ABOUT INVESTING

Take a standard 64 square chessboard and place a $1 bill on the lower left hand square. In the square to its right place $2. Double that to $4 for the third square and keep doubling the amount of money that you place on each square until you reach the last square on the board. The actual formula is (2^64-1). The total number of dollars that you will have to place on the number 64 square is: $18,446,744,073,709,551,615… (18*10^18, or over $18 billion billion). To quote Albert Einstein, “Compounding is the most powerful force in the universe.”